An Introductory Guide to Trailing Stop, Trailing Stop-Loss and Trailing Stop-Sell Order in Cryptocurrency

Have you ever surprised how the expert traders ride on the big crypto trades?

Do you know any secret or a type of trend that keeps your trade earning profits higher and stop losses- while doing nothing?

Well! This secret could be using Trailing Stop.

The expert traders use different advanced trading strategies like Trailing stop loss, Trailing stop sell, etc.

Will it work?

Of course! Using expert techniques to trail your stop loss can reduce risks and let you ride the massive trends. Generally, the trailing stop order sets the trigger price at a fixed distance from the market price. The trigger price here adjusts dynamically relative to the market.

Are you a beginner and facing a problem while trading cryptocurrency? If yes, then you should consider trading at TrailingCrypto.

And, you know when I was a beginner and discovered Trailing stop and Trailing stop-loss and Trailing stop sell features at TrailingCrypto that almost all the major crypto exchanges provide; crypto trading has become very easy.

Well, you know these features aren’t as complicated as they sound, and here is the introductory guide for you which will help in preventing crypto losses. This guide will help you understand different types of Trailing Stop orders.

Trailing Stop

The idea behind Trailing stop is quite simple. In this order type, a value either a percentage or fixed amount is set after a position has been entered into, typically as a stop loss order. And, when that value is reached through the price drop in cryptocurrency, the decision to sell that particular crypto asset is made automatically.

Trailing stops only move up. This means, if the price of crypto asset is rising, your stop will trail behind it to the specified value and you will always keep those increasing profits. Most expert traders use this feature to earn profits.

Let’s understand it with an example:

Suppose a crypto trader is holding a long position of BTCUSD contracts at $8,000 and a trailing distance has been set at $500. Once the last traded price goes up, the Trailing Stop will move in the upward direction and will maintain the trailing distance of $500.

For example,

If the last traded price moves up to 8,600 USD, the Trailing Stop Price will automatically be adjusted to $8,100 and locks in the profit. This means that the Stop Loss will trigger only if the price drops by $500 from the highest price reached. However, if the price never went up the Trailing Stop will be triggered a $7,500 just like a normal Stop Loss.

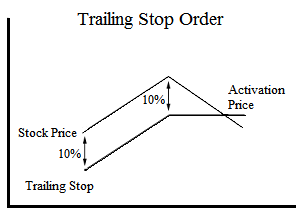

Trailing stops provide efficient ways to manage risks and traders use them as a part of their exit strategy. If a trailing stop loss of 10% is added to a long position, the sell order will be executed if the price drops 10% from the peak price after the purchase.

So, a trailing stop order can limit your losses and enables you to protect a position without any risk of taking profits too early. The trailing stop order only moves in one direction.

For a trailing stop to sell, placed on a long position, it will only move up. And, for trailing stop to buy, placed on a short position, it will only move down.

Trailing Stop buy

Trailing stop buy is placed at a fixed amount above the current market price. As the price of crypto asset falls, the trigger price is adjusted so that it is never more than a specified value or trail from the market price. If the price increases, the trigger price doesn’t adjust. And, the asset will be purchased at the best price.

EXAMPLE

Say, you want to buy BTC, but you think it will fall in value and want to wait to purchase it. You also think that if BTC moves up by a defined amount (let’s say 5%) it may go even higher. In an attempt to help minimize potential costs, you set the trail to 5%. Your stop price will always remain 5% above BTC’s lowest price.

BTC is currently trading at $110 per coin. Your stop price will start at $115.50, which is 5% higher than the current price of BTC.

· If BTC stays between $110 and $115.50, the stop price will stay at $115.50.

· If BTC falls to $100, the stop price will update to $105, 5% above than the new lowest price.

· If BTC rises to the stop price ($105) or higher, it will trigger buy market order. BTC will be purchased at the best price currently available.

Trailing Stop Sell

Trailing stop sell is placed at a fixed amount of the current market price of the crypto asset. As the price of cryptocurrency increases, the trigger price is adjusted automatically so that it is never more than a specified value or trails away from the market price. If the market falls, the trigger price doesn’t adjust.

Let’s understand it with an example:

You own BTC. You think BTC will rise in value, but want to help protect yourself in case it falls in value. If you set your trail to 5%, your stop price will always remain 5% below BTC’s highest price.

BTC is currently trading at $100 per share. Your stop price will start at $95, which is 5% lower than the current price.

· If BTC stays between $100 and $95, the stop price will stay at $95.

· If BTC rises to $110, the stop price will update to $104.50 which is 5% below the new highest price.

· If BTC falls to the stop price ($95) or lower, it triggers a sell market order. BTC will be sold at the best price currently available.

A Trailing Stop Sell order sets the initial stop price at a fixed percentage below the market price as defined by the Trailing Amount. As the market price rises, the sell stop price rises one-to-one with the market but always at the interval set initially by the trailing percentage amount.

Steps to place a trailing stop sell order at TrailingCrypto

· Select Trailing Stop Sell order type

· Select Base and Quote coin.

o E.g. Market: BTC/LTC

· Select the number of coins which need to be sold. You can also select the percentage option to specify relative coin volume.

o E.g. 10 coins. (quantity could be in the fraction)

o Or 20% of quote coin.

· Enter the quote coin price at with you bought. If it is left blank, the current market bid price will be used.

o E.g. 0.01516 BTC

· The offset is a fixed percentage value below the market price. Using this, a stop loss order is placed with an offset of x% from the peak market. If the market will go up, stop loss value will go up. If the market comes down stop loss will not change.

o E.g. Offset = 3%

If the stock price falls, the stop price remains the same. When the stop price is hit, a market order is submitted. Reverse this for a buy Trailing Stop order. This strategy may allow an investor to limit the maximum possible loss without limiting possible gain.

How to use Trailing Stop order?

With a trailing stop order, the trailing stop price follows, or “trails,” the best price of the cryptocurrency by a trail that you specify. If the crypto asset’s price moves in a favorable direction, the trailing stop price will move with the crypto asset. If the price of the cryptocurrency moves in an unfavorable direction, the trailing stop price will remain the same.

If the asset’s price reaches the trailing stop price, a market order will be triggered. The market order will be executed at the best price currently available. While placing a Trailing stop order, one must keep in mind that the short-term fluctuation on the asset price can trigger a trailing stop order.

To better understand how Trailing stop works, consider a crypto asset with the following data:

· Buying price of an asset, X $10

· Last price at the time of setting Trailing Stop $10.05

· Trading amount 20 cents

· Immediate effective stop loss value $9.85

If the current market price of the crypto asset, X moves to $10.97, your trailing stop value will rise to $10.77.

And, if the last price drops to $10.90, your stop value will remain the same i.e. $10.77.

If the price of the crypto asset continues to drop and it reaches to $10.76, it will automatically enter the stop-level, and will trigger a market order immediately.

So, the order is submitted based on the last price of crypto asset X at $10.76. Assuming that the bid price was $10.75 at that time, the position would be closed there and the net gains in this trading would be $0.75 per crypto coin and less commission.

During the price dips, it is a must to reset trailing stops, or else your stop loss may end up lower than expected. By the same token, restricting to the Trailing Stop Loss is advisable when you see continuous peaking in the charts, especially when the asset price is hitting a new high.

Trailing Stop loss

Trailing stop loss is another popular strategy used by the expert crypto traders to managing their investments to reduce risks. This order type moves with the market and buys or sells the crypto asset if the price reaches to a certain point.

This type of order is designed so to protect against the sudden drops in the crypto asset price along with giving traders an opportunity for gains or increases in the market value. To calculate trailing stop loss, you need to know how many crypto coins you want to buy or sell for a particular asset and at what percentage below or above the market price.

Before understanding this order, first understand what is stop loss with an example?

Let’s say that you buy a crypto asset A at $100. Let’s say that you want to limit your losses — if the asset A, trades at $90 or below, then you will sell.

You can put in a stop loss at $90, and your crypto trading bot will execute your sell order if the stock trades down to $90. This is a stop loss.

Trailing stop loss

A trailing stop loss is different from stop loss. Rather than setting a stop loss based on a particular price, you would be setting a stop based on how far the asset declines from its peak.

The distance at which the Trailing Stop Loss (TSL) follows the price can be determined as a percentage, so if the current price of an asset X was $100 and you had a TSL of (-10%) then your Trailing stop loss value would begin at $90 and follow the price at a maximum deviation of 10%.

Trailing stop loss orders are important for three main reasons:

· It can help you to make the most of your crypto investments. If a trailing stop loss is set at 20% and the market keeps on rising, then if it gets up to 100%, it will trigger an order to sell those crypto assets for a profit. No matter how small or large that profit might be. This means that the traders are able to take advantage of rising markets without needing to watch the market constantly.

· Trailing stop loss can also help you avoid losses from a falling crypto asset price. If, for example, the price for BTC is dropping and it falls down to 80%, then the order will trigger once it gets up to 100%. This means that if the trader waits until their stocks hit 0% to sell, they will end up losing a lot of money in the process.

· These orders make it easier to take profits on all your investments: If you set your trailing stop loss at 20%, then if prices reach 100% and drop back down again, an order will trigger once they get back up to 120%. This means that the traders are able to take profits on their investments without having to watch the market constantly, which is not always possible.

Let’s understand it with another example:

Let’s say that you buy 1000 shares of crypto asset X at $100, and you decide to implement a trailing stop of $5. If the stock immediate trades down to $95, then your sell order will be executed.

However, let’s say that the crypto asset X immediately trades up to $120. Your trailing stop would mean that if the asset traded back down to $115, then your sell order would be executed.

The trailing stop loss trails the price of the asset, and executes based on whether or not the stock falls a certain % (or $ figure) from its peak.

So, if you buy the crypto asset X at $100 and set a trailing stop of $5, and the stock immediately trades up to $200 and then back down to $190, then your trailing stop loss order would have been executed at $195.

How to calculate the Trailing stop loss order?

The trailing stop loss order is expressed as a percentage, and can be calculated by subtracting the current market price from your desired selling point.

For example:

If you want to set the trail at 20% of whatever the market price of that asset currently, then you would calculate it as current market price –selling point.

Suppose you buy 100 BTC at $25 per coin. Set a trailing stop loss order to sell it automatically if the price drops by 20% or more, which would be {($25 — ($25 x 0.800)} = $23 rounded up.

This means you can set an order to sell your crypto coins automatically if the price reaches to $23 per crypto asset or below.

Let’s understand Trailing stop loss order with another example:

Trailing stop loss for long trader

Say, you enter a long trade at $40, with a trail of $0.10 trailing stop at $39.90.

If the price moves up to $40.10, the trailing stop value will move to $40. And, at $40.20, it will move to $40.10.

And, here if the price moves back to $40.15, the trailing stop will remain the same which means it will stay at $40.10. If the price falls down continuously and reached to $40.10, the trailing stop loss order will be triggered and would be converted into a market order.

Here, you will exit the trade at $40.10, which means that you have protected $0.10 profit per crypto asset.

Trailing stop loss for a short trade

The trailing stop loss scenario for a short trade is similar to as for the long trade except that you are expecting the cryptocurrency price to drop, so the trailing stop-loss feature will be placed above the entry price.

Let’s say you are entering a short trade by selling a crypto asset at $40 per share. With a trail set at $0.10 trailing stop loss, you would be stopped out with a %0.10 loss if the price moves up to $40.10.

If the price drops down to $39.80, the stop loss will drop to $39.90. And, if the price increases to $39.85, the stop loss price will remain the same at $39.90.

And, if the price falls down to $39.70, the stop loss will fall to $39.80. If the price increases to $39.80 or higher, then this order will be converted into a market order and you will exit the trade with a gain of $20 per share.

How to use Trailing Stop Loss order at TrailingCrypto?

· Select Stop Loss order type.

· Select Base and Quote coin. E.g. Market: BTC/LTC

· Select the number of coins that need to be sold. E.g. 10 coins. (Quantity could be in the fraction)

· Now, click on the drop-down menu near Take Profit. It will pop up with 3 options: Market, Limit, and Trailing. Selection of an option means when market price (ask price) rises to the Stop value, the selected order in the drop-down menu will be executed (Market Sell, Limit Sell, or Trailing Sell).

o E.g if the current ask price of LTC is 0.011189 BTC.

o Stop value can be a place at 0.011000, ~2% below the current price.

o Suppose the market hit 0.011000. This will trigger subsequent orders. Below are the possibilities:

o Market Sell: A Market Sell order will be placed.

o Limit Sell: A Limit Sell order will be placed having limit value mentioned during placing the order.

o Trailing Stop Sell: A trailing Stop sell order will be placed with the mentioned offset during placing the order.

Conclusion

Here we have seen how Trailing stop, trailing stop sell and Trailing stop loss orders work and are the best tools to lock in profits while trading cryptocurrencies. TrailingCrypto is one of the best crypto trading platforms offering all these popular order types and allowing traders to place their trades automatically.